Debtor Turnover Days Formula

How do you calculate debtors turnover in days. Creditor Days Ratio Trade CreditorsCredit Purchases365 However if information for the credit purchases is not.

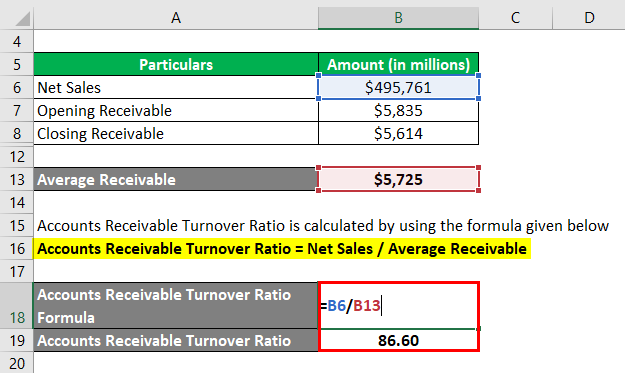

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

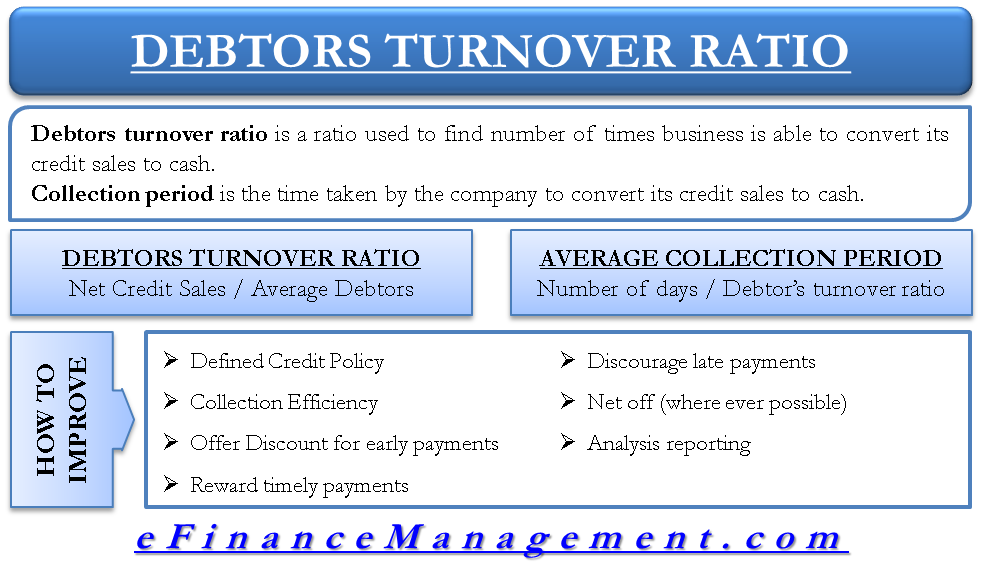

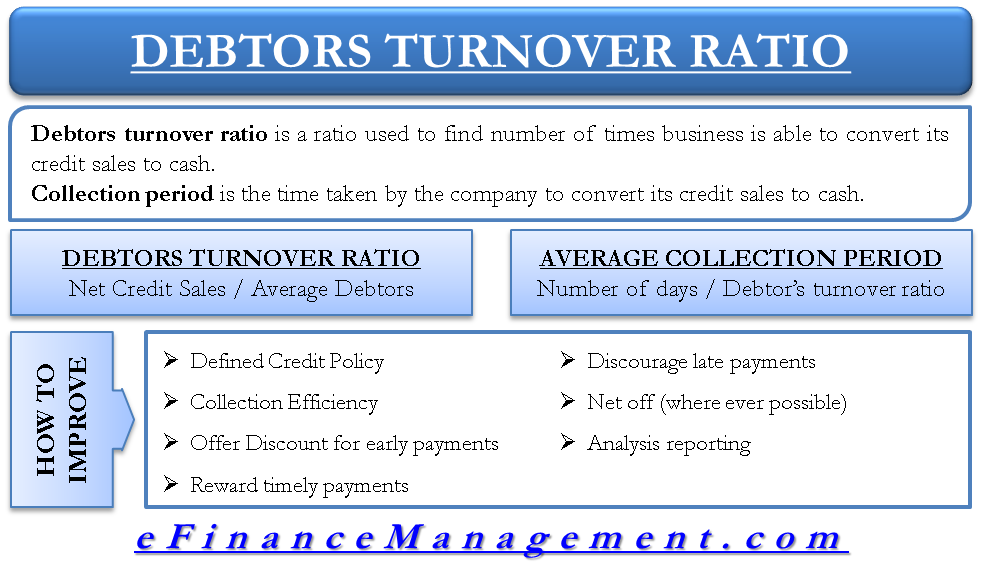

Higher the Debtors turnover ratio better.

. The equation to calculate Debtor Days is as follows. How do you calculate debtors turnover in days. Debtor Days accounts receivableannual credit sales 365 days.

The average accounts receivable turnover in days would be 365 1176 which is 3104 days. Debtors or Trade Receivables Turnover Ratio Net Credit Sales Average Trade Debtors or Receivables Here 1. Debtor Days 5475 days.

The equation to calculate Debtor Days is as follows. The above example shows you how you would calculate trade debtor days at March 2020 using the trade debtor balance and gross billings for the prior three months. Debtors turnover ratio is calculated with the help of the following formula.

Debtors Turnover Ratio Financial Management. Debtors Turnover Ratio Net Credit Sales Average Trade Debtors 24000 4000 6 Times 25000 less 1000 return inwards 3000 plus. Creditors turnover ratio is also known as Payables Turnover Ratio Creditors Velocity and Trade Payables Ratio.

Calculate debtors turnover ratio. Divide your accounts receivables by your total credit sales and multiply by the number of days in that period. How do you calculate debtors turnover in days.

Debtor Days Formula Debtor Days Average Accounts Receivables Credit Sales 365 Days Using a companys credit sales results in a more accurate metric than using the total sales. May 30 2022. It is an activity ratio that finds out the relationship between.

The equation to calculate Debtor Days is as follows. Debtor Days Receivables Sales 365 Days Debtor Days 3000000 20000000 365. For Company A customers on average take 31 days to pay their receivables.

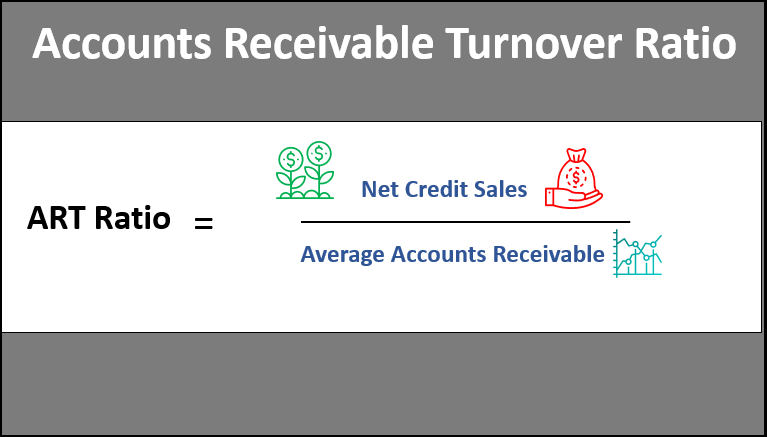

What is the Accounts. Debtors Turnover Ratio Net Credit SalesAverage Account Receivable. Where Average Account Receivable includes trade debtors and bill receivables.

You can calculate the CDR by applying the formula. Formula for debtor turnover days. This is a question our experts keep getting from time to time.

Debtor Days accounts receivableannual credit sales 365 days. So if you are calculating your annual debtor days the formula looks like this. What is the Accounts.

Now we have got the complete detailed explanation and. Debtor Days accounts receivableannual credit sales 365 days. Whilst this gives you an.

What is the Accounts.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

Receivable Turnover Ratio Formula Meaning Example And Interpretation

Accounts Receivable Turnover Ratio Accounting Play

How To Improve Receivable Turnover Ratio Collection Period

0 Response to "Debtor Turnover Days Formula"

Post a Comment